Fundamentals of asset tokenization

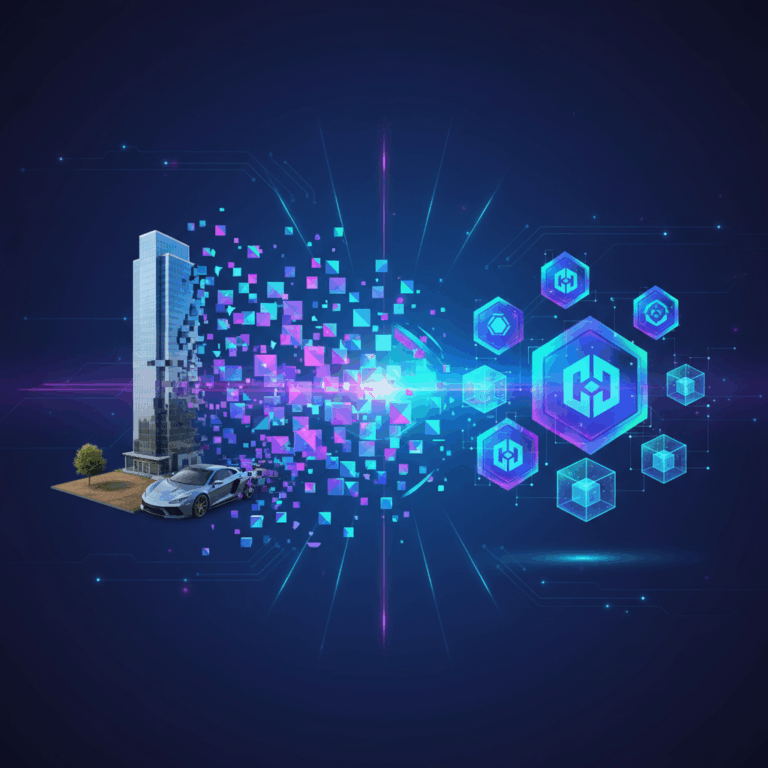

The asset tokenization It is the process that converts rights to a real asset into unique digital tokens, recorded on a blockchain. These tokens reflect fractions of the asset's value and allow for more efficient management.

This mechanism offers security, transparency, and predictability to ownership, facilitating transfer and negotiation that overcomes the limitations of the traditional financial system.

Definition and main characteristics

Tokenization involves representing property rights or benefits linked to an asset through digital tokens, which operate on a blockchain, guaranteeing immutability and traceability.

Digital tokens can divide the value of an asset into parts, granting proportional rights, allowing for greater flexibility, liquidity, and access for investors with limited capital.

Its main features include security, auditability, and the ability to automate distributions and governance through smart contracts.

Types of assets that can be tokenized

Physical assets such as real estate, works of art or vehicles can be tokenized, as well as financial assets such as stocks, bonds or dividend rights.

Intangible assets such as patents or intellectual property rights are also included, expanding investment and negotiation possibilities in various economic sectors.

Proper selection and prior valuation of the asset is fundamental to ensuring its representativeness and legal compliance during token issuance.

Tokenization process

The tokenization process involves several essential stages to transform physical or financial assets into digital tokens, ensuring security and transparency.

Each phase fulfills a key function to ensure the validation, legality, issuance and efficient distribution of tokens in global and accessible markets.

Asset selection and valuation

First, the asset to be tokenized is identified, its value is evaluated, and it is verified that it can be clearly represented digitally on the blockchain.

This phase is crucial to ensure the viability of the token and to define the fraction or rights that each issued token will represent.

Considerations should include aspects such as the physical, financial or intangible nature of the asset and its ability to be divided into negotiable parts.

Legal and regulatory structuring

Before issuing tokens, it is essential to establish a legal framework that defines the rights transferred and complies with current regulations.

This includes the creation of contracts and legal vehicles to support the issuance, protecting investors and ensuring transparency and compliance.

Respect for local and international regulations avoids legal risks and strengthens confidence in the tokenization process.

Token issuance via blockchain

Tokens are generated on a blockchain using smart contracts, which allow for the programming of specific rights and conditions.

Each token can reflect a portion of the asset or certain associated rights, such as rents or participation in related decisions.

Blockchain technology ensures immutability, traceability, and reduces the need for intermediaries in property management.

Token distribution and trading

The tokens are distributed through specialized platforms, reaching public or private investors interested in the tokenized asset.

This facilitates global and continuous trading, increasing the liquidity of assets that are traditionally difficult to sell or break up.

Fractional ownership allows for greater accessibility and potential diversification for investors in digital markets.

Advantages and benefits of tokenization

Tokenization offers democratized access to assets that were previously inaccessible to small investors, by allowing their division into digital parts. This increases participation in diverse markets.

Furthermore, transparency is key, as all transactions are recorded on the blockchain, ensuring traceability and trust. This leads to a significant reduction in operating costs and fees.

Access, transparency and cost reduction

Thanks to the fractionability With this asset allocation, investors with less capital can access higher-value investments, easily diversifying their portfolios. This broadens the spectrum of financial opportunities.

Blockchain technology ensures that all transactions have a public and immutable record, promoting transparency and reducing the risk of fraud or manipulation.

Eliminating intermediaries and automating processes reduces administration, custody, and commission costs, making investment and asset management more efficient and economical.

Automation of management and governance

Through smart contractsTokenization facilitates the automation of administrative functions such as profit distribution or record updates, optimizing time and reducing human error.

Furthermore, these contracts allow for the implementation of decentralized governance mechanisms, where token holders can participate in decisions about the asset in an agile and secure manner.

This automation not only improves efficiency, but also strengthens transparency and trust in the management of digital assets.

Challenges and future prospects

The development of tokenization faces key challenges in adapting the legal framework to ensure legal certainty and investor protection in a digital environment.

Regulatory developments will be crucial in fostering trust and ensuring that tokenization can expand safely and in an orderly manner in global markets.

Regulatory framework and regulation

One of the main challenges is the creation of clear and specific regulations that recognize tokens as legal assets and regulate their issuance, trading, and custody.

Different jurisdictions are working to adapt their regulatory frameworks to integrate blockchain technology without losing control over fraud or money laundering.

Furthermore, the framework must balance innovation with protection, establishing standards for smart contracts and the liability of issuers and custodians.

International harmonization of rules will be crucial to facilitate cross-border transactions and interoperability between decentralized markets.

Acceptance and protection of digital rights

The social and legal acceptance of rights linked to digital tokens depends on effective mechanisms to protect ownership and ensure transparency in management.

It is essential to implement secure and regulated custody systems to prevent fraud, ensure ownership, and support the transfer of digital rights.

Education and trust among users, investors, and institutions will be crucial for tokenization to reach its disruptive potential in the financial sector and other markets.