Definition and function of interest rates

The interest rates They represent the time value of money and are essential for understanding the current economy. They function as an indicator of the cost of borrowing money and the profitability of investing it.

This rate affects individuals, businesses, and governments alike, determining how much is paid for a loan or how much is earned on a deposit. Its primary function is to balance the supply and demand for money in the financial market.

The importance of interest rates lies in their impact on fundamental economic decisions, such as saving, investing, and spending. Their fluctuations directly influence the overall economic health and everyday personal finances.

Concept of interest rates as cost and profitability

The interest rate is the cost borne by the borrowerbecause it must repay the principal plus an additional percentage. This is the consideration for using someone else's capital for a specific period of time.

For investors, the interest rate is the profitability you obtain by lending or depositing your moneyThis means that, when investing, they expect to receive a percentage that compensates for risk and inflation.

Thus, the interest rate functions as a mechanism that It balances the interests of borrowers and investors., reflecting the supply and demand of funds in the economy.

Importance in the economy and personal finance

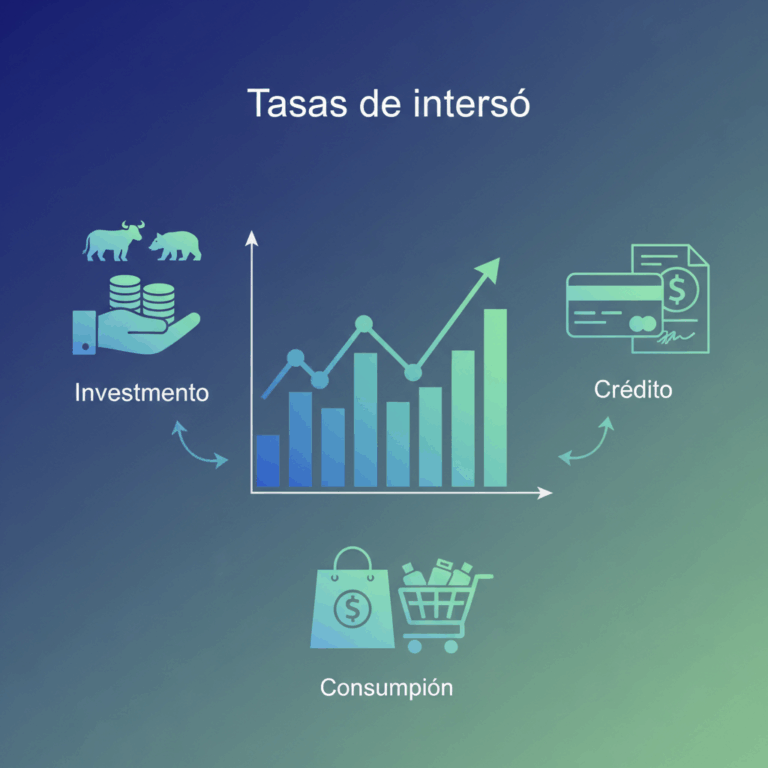

In economics, interest rates affect investment, consumption, and savings. A change in these rates can accelerate or slow economic growth, as it influences access to credit and financial decision-making.

For personal finance, interest rates determine the profitability of savings and the cost of borrowing. This directly impacts the purchasing power and financing options of families and businesses.

Therefore, knowing and understanding interest rates allows for more informed decisions and better adaptation to changing economic conditions.

Impact of interest rates on investments

The interest rates They decisively influence investment behavior, affecting the choice between safe and risky assets. Their fluctuations change the perception of profitability and risk.

Understanding how interest rates affect different financial instruments is key to making sound decisions and optimizing the performance of investment portfolios in different economic contexts.

The dynamic between interest rates and markets defines economic cycles and determines the confidence and strategies of investors in fixed income, equities, and other financial options.

Effect of high interest rates on fixed income and stock market products

When interest rates rise, the profitability of products fixed income as bonds increase, which usually attracts investors looking for security and stable returns.

On the other hand, high interest rates make business financing more expensive, which can reduce corporate profits and, consequently, negatively affect the market. shares.

In this scenario, the stock market may experience lower demand because investors prefer more profitable and less risky fixed-income products.

Consequences of low interest rates on risky investments

In a context of low interest rates, the profitability of safe products decreases, encouraging investors to look for options with greater risk and potential for profit.

This situation usually benefits the bag These assets, such as investment funds or venture capital, are gaining prominence by offering better returns compared to traditional fixed income.

However, this behavior can increase the volatility of the market and increase the risk exposure of investment portfolios.

Relationship between business financing and interest rates

Interest rates directly influence the cost of financing for businesses, affecting their capacity for investment and expansion. Low interest rates facilitate access to cheaper credit.

When financial costs rise, many companies reduce or postpone projects, which can limit their growth and, at the same time, negatively impact the value of their shares.

Therefore, interest rate policy affects not only direct investors but also the financial and strategic health of companies in the markets.

Influence of interest rates on loans

The interest rates They are essential for determining the cost of loans accessed by households and businesses. Their fluctuations directly impact the economy and the financial behavior of these agents.

Higher interest rates make borrowing more expensive, reducing the willingness to take out loans. Conversely, low interest rates make credit cheaper, promoting access to credit and increasing the capacity for consumption and investment.

Therefore, understanding these effects is key to understanding how financial decisions depend on the economic context and current monetary policy.

Changes in borrowing costs and their impact on families and businesses

When interest rates rise, the cost of borrowing increases significantly for families and businesses. This limits their borrowing capacity and makes it harder to finance expenses or investments.

Families may postpone major purchases such as homes or cars, while businesses face higher costs when financing their operations or expansions.

Conversely, low interest rates make loans more affordable, facilitating both household consumption and business investment, thus boosting economic growth.

Effects of the increase and decrease in the cost of credit

Higher borrowing costs reduce demand for loans, which can slow the economy by decreasing spending and investment. Furthermore, it increases the financial burden for those already in debt.

In contrast, cheaper credit stimulates consumption and investment, facilitating projects and purchases, but it can also encourage excessive debt that should be controlled.

Thus, interest rate policy seeks a balance between encouraging economic activity and avoiding financial risks arising from excessive credit.

Relationship between interest rates and consumption

The interest rates They are a key factor that directly influences household consumption behavior. Changes in these rates modify the willingness to spend or save.

When interest rates are low, families tend to take advantage of the opportunity to make financed purchases, as the cost of money is more accessible and the incentive to save decreases.

In contrast, high interest rates tend to encourage saving and restrict spending, affecting the frequency and volume of consumption in the household economy.

Incentives to consumption with low interest rates

With some low interest ratesThe cost of obtaining credit is considerably reduced, making it more attractive to finance major purchases such as vehicles, homes, or appliances.

Furthermore, the profitability of savings decreases, leading people to prefer spending rather than saving their money, thus increasing overall consumption.

This environment creates a stimulus for the economy, as increased consumption boosts production and employment in various sectors.

Preference for saving and reduced consumption with high interest rates

When the Interest rates are highThe cost of borrowing is rising, and the appeal of saving is increasing due to better returns on accounts and deposits.

This causes families to prioritize accumulating funds, postponing or reducing expenses, which decreases consumption and can slow economic activity.

Furthermore, consumer credit becomes more expensive, discouraging the purchase of financed goods and particularly affecting products that are frequently or frequently purchased.