Instruments of fiscal policy

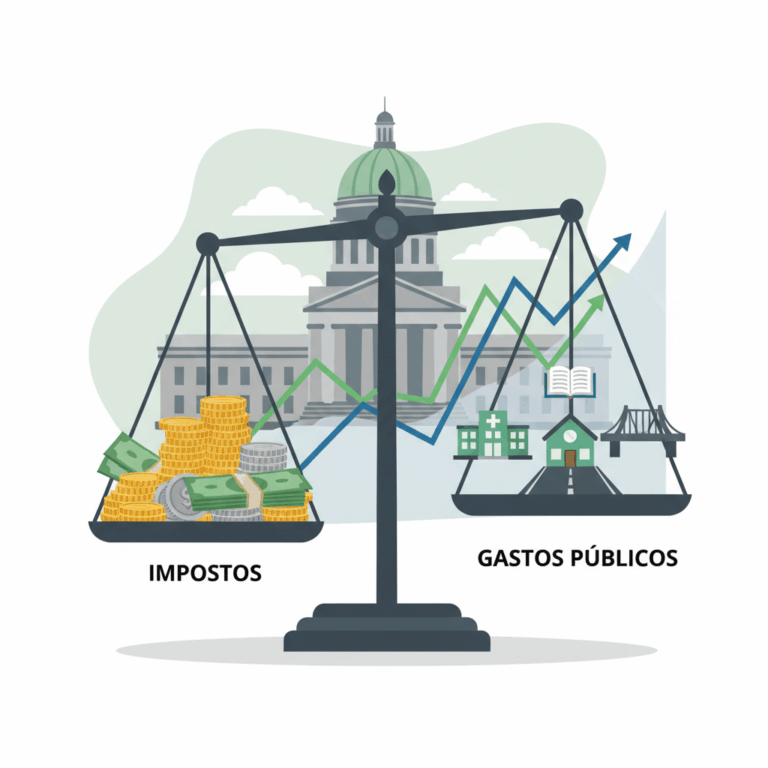

Fiscal policy primarily uses two instruments: taxes and government spending. These mechanisms allow the government to influence the economy directly and effectively.

Taxes regulate the financial capacity of citizens and businesses, while public spending channels resources to strategic sectors to promote economic development.

These instruments are vital for controlling aggregate demand and responding to different economic situations, either by stimulating the economy or moderating its growth.

Taxes as an economic tool

Taxes are an essential source of revenue for the government, enabling it to finance public policies and basic services. Changing tax rates affects disposable income and economic behavior.

By reducing taxes, the government can encourage consumption and investment, thereby supporting economic activity during times of slowdown.

Conversely, raising taxes can help curb excessive growth and contain inflation by adjusting demand.

Public spending and its impact

Public spending acts as an economic engine by injecting resources into sectors such as infrastructure, education, and health, generating employment and improving the quality of life.

Increasing public spending can stimulate the economy during recessions, increasing demand and promoting productive activity.

However, uncontrolled excessive spending can cause budget imbalances and inflation, so its management must be careful and strategic.

Types of fiscal policies and their effects

Fiscal policies can take different forms to influence the economy, with two main types standing out: expansionary and contractionary. Each pursues clear objectives in different economic contexts.

These approaches allow the government to act to stimulate growth or control phenomena such as inflation, balancing the economy and protecting social welfare.

Furthermore, the State plays a stabilizing role, using these policies to mitigate fluctuations and promote sustainable and balanced development.

Expansionary fiscal policy and economic stimulus

Expansionary fiscal policy is implemented when the economy is weak or in recession. It involves increasing government spending or reducing taxes to stimulate aggregate demand.

Injecting money through investments or reducing the tax burden encourages consumption and investment, which generates employment and revives production.

This strategy seeks to revive economic growth and restore stability to the labor market, reducing the negative impact of the slowdown.

Restrictive fiscal policy and inflation control

When the economy overheats, restrictive fiscal policy reduces spending or increases taxes to moderate demand and contain inflation.

Reducing the amount of liquidity available in the economy helps prevent uncontrolled price increases, stabilizing the purchasing power of citizens.

These measures are essential to maintain macroeconomic balance and avoid bubbles that could trigger future crises.

The stabilizing role of the State

The State uses fiscal policy as a tool to smooth out economic fluctuations, acting preventively against abrupt changes in activity.

By regulating public income and expenditure, the aim is to achieve sustained growth, stable employment, and controlled prices, thus guaranteeing economic stability.

This stabilizing role is key to avoiding prolonged crises and ensuring a favorable environment for development and social well-being.

Fiscal policy and social redistribution

Fiscal policy not only influences the economic cycle, but is also fundamental to reducing social inequalities. Through progressive taxation, the state can redistribute wealth.

Through tax collection and public spending directed towards social programs, the aim is to improve the well-being of the most vulnerable sectors, promoting greater equity in society.

Taxes and reducing inequalities

Progressive taxes tax those with greater economic capacity more heavily, allowing for the financing of essential public services for those with fewer resources.

This redistribution of income helps to reduce social and economic gaps, strengthening social cohesion and sustainable development.

Furthermore, the efficient use of these resources in education, health, and social protection expands opportunities and improves the quality of life for the entire population.

Objectives and functions of fiscal policy

The main objective of fiscal policy is to promote economic and social development through the management of public revenues and expenditures. Its function is to balance growth, stability, and equity.

Through appropriate measures, the State can promote job creation, ensure essential services and reduce inequalities, contributing to collective well-being.

Promoting economic growth and employment

Fiscal policy promotes economic growth through tax incentives and strategic spending, stimulating production and investment in various sectors.

By promoting infrastructure and education projects, direct and indirect jobs are created, benefiting the economy and improving the quality of life of citizens.

Furthermore, maintaining a stable and predictable fiscal environment fosters investor and business confidence, facilitating long-term sustainable development.

Guarantee of essential services and social welfare

Through proper tax collection and efficient distribution of public spending, fiscal policy ensures access to health, education, and social protection for the entire population.

The State uses these resources to strengthen the welfare system, guaranteeing dignified and equitable conditions that promote social inclusion.

These essential services contribute to reducing poverty and improving the quality of life, supporting social cohesion and the stability of the country.